•

ABD, Venezuela'ya Karadan Saldırı Başlattı: Caracas Halkı Şehirden Kaçıyor

|

•

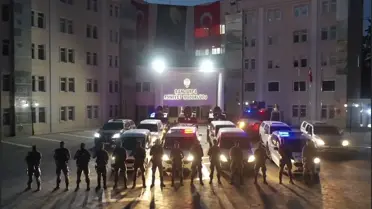

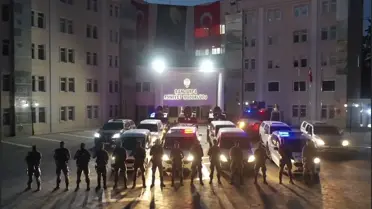

Şanlıurfa’da DEAŞ Bağlantılı 13 Şüpheli Gözaltına Alındı, 4’ü Tutuklandı

|

•

Caracas'ta Şok Patlamalar: ABD'den Saldırı Talimatı ve Maduro'nun Acil Durum Açıklaması

|

•

Trump, Venezuela’yı ABD Yönetimine Teslim Etme Planını Açıklıyor

|

•

Maduro ve Eşi ABD'de Tutuklandı: Metropolitan Tutukevi'ne Transfer Bekleniyor

•

ABD, Venezuela'ya Karadan Saldırı Başlattı: Caracas Halkı Şehirden Kaçıyor

|

•

Şanlıurfa’da DEAŞ Bağlantılı 13 Şüpheli Gözaltına Alındı, 4’ü Tutuklandı

|

•

Caracas'ta Şok Patlamalar: ABD'den Saldırı Talimatı ve Maduro'nun Acil Durum Açıklaması

|

•

Trump, Venezuela’yı ABD Yönetimine Teslim Etme Planını Açıklıyor

|

•

Maduro ve Eşi ABD'de Tutuklandı: Metropolitan Tutukevi'ne Transfer Bekleniyor

Trump, Venezuela’yı ABD Yönetimine Teslim Etme Planını Açıklıyor

Kars’ta 111. Sarıkamış Şehitleri Anısına Binlerce Katılımcı Meşaleli Yürüyüşe Katıldı

Iğdır'da Kontrolsüz Kamyonet Çarpması Sonrası Şiddetli Yangın

Fenerbahçe Tribün Liderine Yönelik Silahlı Saldırının Ardından 10 Şüpheli Tutuklandı

Mobil Oto Yıkama ve Çevre: Gizli Tehlikeler Ortaya Çıkıyor

BYD, 2025'te Tesla'yı Geride Bırakarak Elektrikli Araç Pazarının Lideri Oldu

Denizlerdeki SİDA'larla Türk Savunma Sanayii Yeni Bir Döneme Giriyor

Genç Girişimcilerin Buluşma Noktası: TEKNOFEST 2026

Mardin’in Bembeyaz Kış Masalı: Sisli Sokaklarda Dronla Çekilen Görüntüler

Bursa Uludağ Üniversitesi'nden 3B Yazdırılabilir Beton Laboratuvarı: Geleceğin Yapılarına Kapı Açıyor

VİDEO

Tüm Videolar

Video

ABD, Venezuela'ya Karadan Saldırı Başlattı: Caracas Halkı Şehirden Kaçıyor

Video

Maduro ve Eşi ABD'de Tutuklandı: Metropolitan Tutukevi'ne Transfer Bekleniyor

Video

15 Yaş Altı Çocuklar İçin Sosyal Medya ve Oyun Platformlarında Kimlik Doğrulama Zorunlu Olacak

Video

Dr. Alihan Limoncuoğlu'ndan İran Protestolarına Dair Çarpıcı Değerlendirme: Savaş İhtimali Yok

Video

Temassız Kartlarda Limit Artışı: 2.500 TL’ye Yükseliyor

Video

Mısır’da Yatırımcıları Bekleyen İki Büyük Tuzak: Kalite ve Rekabet Riski

Video

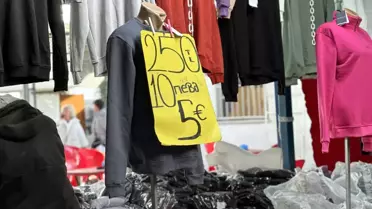

Edirne Sokakları Avro Rüzgarı Estiriyor: Tabelalarda Yeni Dönüşüm

Video

Petro’nun Uluslararası Çığlığı: Venezuela’da Füzelerle Saldırı İddiaları

Video

Maduro'dan Olağanüstü Hal Açıklaması: Ülke Genelinde Savunma Güçleri Konuşlandırılıyor

Video

Belediye Ekiplerinin 'Yardım' Görüntüsü Sahte Çıktı: Kamera Arkasındaki Senaryo

Bu kategoride henüz haber bulunmamaktadır.

ABD, Venezuela'ya Karadan Saldırı Başlattı: Caracas Halkı Şehirden Kaçıyor

Şanlıurfa’da DEAŞ Bağlantılı 13 Şüpheli Gözaltına Alındı, 4’ü Tutuklandı

Caracas'ta Şok Patlamalar: ABD'den Saldırı Talimatı ve Maduro'nun Acil Durum Açıklaması

Trump, Venezuela’yı ABD Yönetimine Teslim Etme Planını Açıklıyor

Maduro ve Eşi ABD'de Tutuklandı: Metropolitan Tutukevi'ne Transfer Bekleniyor

Trump, Venezuela Operasyonunu Canlı İzledi: Detaylar Açıklandı

Bursa’da Lodos Fırtınası: Vatandaşlar Rüzgara Karşı Çeşitli Önlemler Aldı

Trump, Maduro’nun Kaçırma Operasyonunu Canlı İzledi: Görüntüler Açıklandı

Petro’nun Uluslararası Çığlığı: Venezuela’da Füzelerle Saldırı İddiaları

Trump'tan Venezuela Operasyonu: Maduro ve Eşi Sınır Dışı Edildi

Cumhurbaşkanı Erdoğan, 2025 ihracat rekorunu 5 önde gelen şehirle kutladı

Bilecik’te 2025’e Doğru 7,3 Milyar TL’lik Ulaşım ve Altyapı Hamlesi

Bakan Kacır'dan Girişimcilere 2 Milyon TL'ye Kadar Destek: Yeni Fırsatlar

Çin'in Yeni Yıl Tatilinde Yolcu Akını %20,3 Artarak Rekor Kırdı

Samsun’da Kentsel Dönüşüm Rüzgarı: Gülsan Sanayi Sitesi’nde %80 Anlaşma Oranı

Erdoğan, Karadeniz Ticaretindeki Savaş Tehdidini 2025 Dış Ticaret Verileriyle Değerlendirdi

Esnaf İçin Faiz İndirimi: Yeni Nefes ve Moda Dünyasından Bir Dokunuş

Erdoğan'dan 2025 ihracat rekoru: 1,5 trilyon dolar sınırını aştık

Türkiye Savunma İhracatında Yeni Zirve: 10,5 Milyar Dolar Rekoru

TİM Başkanı Gültepe: 2025 Dış Ticaret Hedefiyle Türkiye’yi İlk 10 İhracatçı Ülke Arasına Taşıyoruz

Bulgaristan Euroyu Resmen Karşıladı: Avrupa’da Yeni Para Dalgası Başladı

Bulgaristan’da Euro Dönemi: Alışveriş ve Moda Sahnesinde Yeni Bir Sayfa

ABD'de Çocuk Bakım Fonları Donduruldu: Aileleri Şaşırtan Gelişme

Forbes Türkiye 2025 Listesi: Zirvedeki Değişim ve Şok Çıkış

İran’ın Kripto Hamlesi: Savunma Sektöründe Dijital Ödemelerle Yaptırımları Aşma Planı

Yeni Memur ve Emekli Maaş Zamları Açıklandı: Kuruş Kuruşuna Artışlar

Musk’un Servet Rekoru ve Zengin Listesinde Şok Değişimler

Dolar 43 Lirayı Aştı: Türkiye’nin Döviz Piyasasında Tarihi An

İslam Memiş'ten 2026 Altın ve Gümüş Öngörüsü: İlk Yarıda Yükseliş, İkinci Yarıda Durgunluk

Lloyds Bank’tan Dijitalleşme Hamlesi: 2026’da 71 Şube Kapanıyor

Trump, Maduro’nun Kaçırma Operasyonunu Canlı İzledi: Görüntüler Açıklandı

Demirci’de 59 Yaşındaki Şerife Çınar’ın Kaybı İçin Arama Çalışmaları Hız Kesmeden Sürüyor

Kars’ta 111. Sarıkamış Şehitleri Anısına Binlerce Katılımcı Meşaleli Yürüyüşe Katıldı

Çorum Bayat’ta Sobadan Çıkan Yangın 1 Yaralıyı Yakaladı

Siirt’te Okul Güvenliği İçin Kar ve Buz Temizliği Çalışmaları

Çorum Bayat’ta Sobanın Kontrolsüz Yayılması: 53 Yaşındaki Adam Hayatını Kaybetti

Iğdır'da Kontrolsüz Kamyonet Çarpması Sonrası Şiddetli Yangın

Fenerbahçe Tribün Liderine Yönelik Silahlı Saldırının Ardından 10 Şüpheli Tutuklandı

Dilovası Yangını İddianamesi Delil Eksikliği Nedeniyle Geri Gönderildi

İletişim Başkanı Duran, Özgür Özel'in Erdoğan Eleştirisine Sert Yanıt Verdi

Demirci’de 59 Yaşındaki Şerife Çınar’ın Kaybı İçin Arama Çalışmaları Hız Kesmeden Sürüyor

Başkan Yıldırım ve Eşi Berrin’den Huzurevi Sakinlerine Sıcak Bir Dokunuş

Mantar Zehirlenmesinden Kurtulan Genç Kadın: Karaciğer Nakliyle Yeniden Hayata Döndü

Gupse Özay'ın LvbelC5 İzlerken Yaptığı Komik Mimikler Sosyal Medyada Patladı

Zeynep Özyağcılar, Kışın Buzlu Dansıyla Yeni Yıla Renk Katıyor

Müge Anlı ve Rahmi Özkan’ın Tartışması Sonrası Programdan Ayrıldı: Nedenini Açıklıyor

Şeyma Subaşı’nın Kur’an Paylaşımı Sosyal Medyada Buz Gibi Tepki Topladı

Angelina Jolie, Refah Kapısı'nda Gazze'ye Yardım Çabalarını Yerinde İnceledi

İbo Show’da Yıldız Tilbe’nin Asena’ya Sürpriz İşareti İzleyicileri Şaşırttı

Pamukkale'de 93 Yaşındaki Kadının Trajik Ölümü: Sobadan Çıkan Duman Felaketi

Erbakan'dan Birlik ve Dayanışma Mesajı: İslam Kardeşliğine Dair Açıklamalar

Emel Sayın ve Kubat'tan Yılbaşı Coşkusu: Günay Restaurant'ta Unutulmaz Bir Konser

Yusuf Güney’in Uyuşturucu Testi Sonuçları Açıklandı: Şarkıcı Tepkisini Verdi

Uzak Şehir'in Yeni Bölümü, Duygu Dolu Bir Başlangıçla İzleyiciyi Büyülüyor

Salihli'nin Gizli Mücevheri: Maden Teknisyeni Nazmi Gedikkaya’nın Mermer ve Doğaltaş Koleksiyonu

Kayseri'de Sarıkamış 111. Yıl Anısına 'Karın Beyaz Sessizliği' Tiyatrosu Sahnelendi

Aziz Murat Aslan’ın Karagöz’ü Modern Sorunlarla Buluşturduğu Yeni Sergi Açıldı

Güney Kore Lideri Lee Jae Myung, Xi Jinping’e Şıklık ve İş Birliği Mesajı Verdi

15 Yaş Altı Çocuklar İçin Sosyal Medya ve Oyun Platformlarında Kimlik Doğrulama Zorunlu Olacak

Mobil Oto Yıkama ve Çevre: Gizli Tehlikeler Ortaya Çıkıyor

BYD, 2025'te Tesla'yı Geride Bırakarak Elektrikli Araç Pazarının Lideri Oldu

Denizlerdeki SİDA'larla Türk Savunma Sanayii Yeni Bir Döneme Giriyor

Genç Girişimcilerin Buluşma Noktası: TEKNOFEST 2026

Mardin’in Bembeyaz Kış Masalı: Sisli Sokaklarda Dronla Çekilen Görüntüler

Bursa Uludağ Üniversitesi'nden 3B Yazdırılabilir Beton Laboratuvarı: Geleceğin Yapılarına Kapı Açıyor

Erzurum’da Akıllı Kavşaklar: Yapay Zeka Trafiği Nasıl Dönüştürüyor?

Aras EDAŞ, Yılbaşı Gecesinde Kesintisiz Enerjiyle Işıkları Açıyor

Güney Kore Lideri Lee Jae Myung, Xi Jinping’e Şıklık ve İş Birliği Mesajı Verdi

BYD, 2025'te Tesla'yı Geride Bırakarak Elektrikli Araç Pazarının Lideri Oldu

Genç Girişimcilerin Buluşma Noktası: TEKNOFEST 2026

Mardin’in Bembeyaz Kış Masalı: Sisli Sokaklarda Dronla Çekilen Görüntüler

Erzurum’da Akıllı Kavşaklar: Yapay Zeka Trafiği Nasıl Dönüştürüyor?

Aras EDAŞ, Yılbaşı Gecesinde Kesintisiz Enerjiyle Işıkları Açıyor

Bursa Business School 2025: Türkiye’nin İş Dünyasını Şekillendirecek Yeni Eğitim ve Dönüşüm Merkezi

BYD, 2025’te Tesla’yı Geride Bırakma Planını Açıklıyor

Adana’nın Üretim Gücüne Yeni Soluk: AOSB’nin Çevreci Atılımı

Braille ile Erişimin Gücü: Bayram Özen'den İlham Verici Mesaj

BYD, 2025'te Tesla'yı Geride Bırakarak Elektrikli Araç Pazarının Lideri Oldu

Honda’nın Şok Kararı: Efsane Civic Modeli Pazarından Çıktı!

Aydın’da Düşen Sıfırın Altındaki Sıcaklıklarla Kış Lastiği Talebi Patladı

Silifke’de Motor Bölümünden Çıkan Alevler Aracın Tamamen Yok Olmasına Neden Oldu

Manisa’da Yaşanan Korkunç Kazada Baba-Oğul Yan Yana Defnedildi

Amasya’da Kış Koşullarında Drift Yapan Sürücüye 58.217 TL Ceza Kesildi

Ereğli'de Park Halindeki Araç Yangını Şok Yarattı

Trump, Venezuela’yı ABD Yönetimine Teslim Etme Planını Açıklıyor

Trump, Venezuela Operasyonunu Canlı İzledi: Detaylar Açıklandı

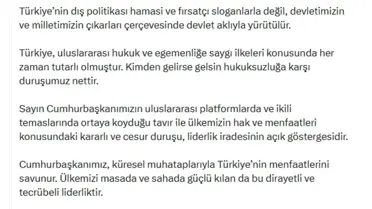

İletişim Başkanı Duran, Özgür Özel'in Erdoğan Eleştirisine Sert Yanıt Verdi

Petro’nun Uluslararası Çığlığı: Venezuela’da Füzelerle Saldırı İddiaları

Başkan Yıldırım ve Eşi Berrin’den Huzurevi Sakinlerine Sıcak Bir Dokunuş

Maduro'dan Olağanüstü Hal Açıklaması: Ülke Genelinde Savunma Güçleri Konuşlandırılıyor

ABD ve Venezuela Arasındaki Gerilim: Karakas’ta Yaşanan Patlamaların Ardındaki Gerçek Nedir?

Caracas'ta Gerginlik Yükseliyor: Patlamalar ve ABD'nin Saldırı Emri

Belediye Ekiplerinin 'Yardım' Görüntüsü Sahte Çıktı: Kamera Arkasındaki Senaryo

Saadet Partisi Üye Rekorunu Kırdı: Son 6 Ayda 67.244 Yeni Üye

ABD, Venezuela'ya Karadan Saldırı Başlattı: Caracas Halkı Şehirden Kaçıyor

Şanlıurfa’da DEAŞ Bağlantılı 13 Şüpheli Gözaltına Alındı, 4’ü Tutuklandı

Caracas'ta Şok Patlamalar: ABD'den Saldırı Talimatı ve Maduro'nun Acil Durum Açıklaması

Maduro ve Eşi ABD'de Tutuklandı: Metropolitan Tutukevi'ne Transfer Bekleniyor

Bursa’da Lodos Fırtınası: Vatandaşlar Rüzgara Karşı Çeşitli Önlemler Aldı

Fenerbahçe Tribün Liderine Yönelik Silahlı Saldırının Ardından 10 Şüpheli Tutuklandı

Berlin’in Şok Yangını: 45 Bin Hane Elektriksiz Kaldı, Şehirde Karanlık Günler

Kuruyemiş Dükkanında Şiddetli Çatışma: Bir Kişi Kafasını Kaldırıma Çarptı, Hayati Tehlike

Aydın Efeler’de Terkedilmiş Bina Yangını Kısa Sürede Söndürüldü

İncirliova’da Patlayan Tiner Yangını: İtfaiye Hızlı Müdahale ile Söndürdü

Erkan Aydın ve Enes Çelik, Bursaspor Vakfı'nda Buluştu: Şehrin Ortak Tutkusunu Konuşturdu

Karpuzlu Kaymakamı’nın Moral Kahvaltısıyla Şehit Şenol Akar Ortaokulu Voleybol Takımı Zaferini Kutladı

ADÜ ve Aydın Gençlik Spor İl Müdürlüğü Yurt Tahsisinde Yeni Protokol İmzaladı

Aydın Hemsball Takımı Türkiye Şampiyonası'nda 4 Kupa ve 16 Madalya Kazandı

Yamalakspor, 4 Ocak Derbisinde Köşk Belediye Doğanspor’u Ağırlaştırıyor

Galatasaray’ın Şıklık Dolu 3-0 Zaferi: Aydın’ı Sahada Yeniden Tanımladı

Trabzonspor, Galatasaray Maçına Hazırlıklarını Tamamlıyor

Al Ahli'nin Şaşırtıcı Zaferi ve Sosyal Medyada Yapay Zeka Tartışması

Fenerbahçe, Süper Kupa Yarı Finali İçin Samsunspor Maçına Hazırlanıyor

Emlak Konut, Çanakkale’de Dardanel’i Boş Kaldırdı

175 Araştırmacı TÜBİTAK 2025 Uluslararası Programına Başvurdu

15 Yaş Altı Çocuklar İçin Sosyal Medya ve Oyun Platformlarında Kimlik Doğrulama Zorunlu Olacak

Mobil Oto Yıkama ve Çevre: Gizli Tehlikeler Ortaya Çıkıyor

BYD, 2025'te Tesla'yı Geride Bırakarak Elektrikli Araç Pazarının Lideri Oldu

Denizlerdeki SİDA'larla Türk Savunma Sanayii Yeni Bir Döneme Giriyor

Genç Girişimcilerin Buluşma Noktası: TEKNOFEST 2026

Bursa Uludağ Üniversitesi'nden 3B Yazdırılabilir Beton Laboratuvarı: Geleceğin Yapılarına Kapı Açıyor

Erzurum’da Akıllı Kavşaklar: Yapay Zeka Trafiği Nasıl Dönüştürüyor?

Aras EDAŞ, Yılbaşı Gecesinde Kesintisiz Enerjiyle Işıkları Açıyor

Bursa Business School 2025: Türkiye’nin İş Dünyasını Şekillendirecek Yeni Eğitim ve Dönüşüm Merkezi

Mobil Oto Yıkama ve Çevre: Gizli Tehlikeler Ortaya Çıkıyor

Batman’da Karla Mücadele: 158 Yerleşim Yolu Yeniden Açıldı

Akşehir'de 800 Milyonluk Şans Rüzgarı: Büyük İkramiye Çekildi

Aydın’da Uyuyan Yaşlı Adamın Sessiz Çığlığı: Komşular Panik İçinde

Cahit Berkay’ın Esenyurt’ta Şaşırtıcı Araç Kazası: Restoran Hasar Aldı

Yusuf Güney'in Uyuşturucu Testi Kokain İçerdi, Sonuçlar Açıklandı

Usta Spiker Gülgûn Feyman'dan Medyada Sert Çıkış: "Bu Kişiler Meslektaşım Değil"

Bursa’da Şiddetli Lodos: Ağaçlar Devrildi, Çatıdan Düşen Kişi Hastanede

İzmir Gaziemir'de Trajik Kaza: Maden İşçisi Hayatını Kaybetti

Demirci’de 59 Yaşındaki Şerife Çınar’ın Kaybı İçin Arama Çalışmaları Hız Kesmeden Sürüyor

Kars’ta 111. Sarıkamış Şehitleri Anısına Binlerce Katılımcı Meşaleli Yürüyüşe Katıldı

Çorum Bayat’ta Sobadan Çıkan Yangın 1 Yaralıyı Yakaladı

Çorum Bayat’ta Sobanın Kontrolsüz Yayılması: 53 Yaşındaki Adam Hayatını Kaybetti

Iğdır'da Kontrolsüz Kamyonet Çarpması Sonrası Şiddetli Yangın

Dilovası Yangını İddianamesi Delil Eksikliği Nedeniyle Geri Gönderildi

İnegöl'de 2 Katlı Konutta Çıkan Yangın Kontrol Altına Alındı

Kahta’da Kışın İz Bırakan Hizmet: Belediye Ekipleri Karla Mücadelede 7/24 Çalışıyor

Sabah Kahvaltısıyla Şehrin Nabzını Dinliyor: Yenişehir’in Belediye Başkanı Ercan Özel’in Güne Erken Buluşması