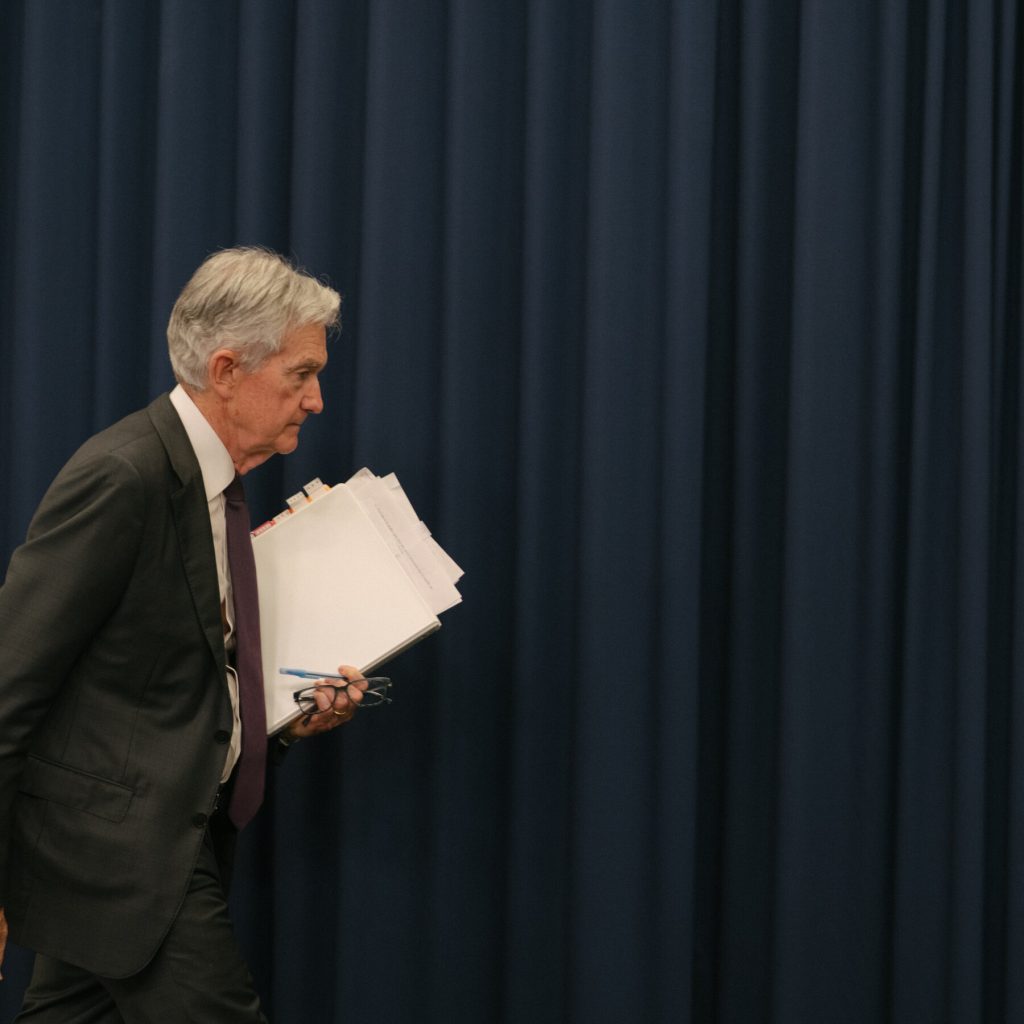

A Tough Job for Jay Powell at the Fed Gets Tougher

The already daunting task of navigating the US economy through uncertain times just got more complicated for Jay Powell, the chairman of the Federal Reserve. As the central bank prepares to make its next move on interest rates, Powell is facing a challenging debate within the Fed’s ranks. On one hand, some policymakers believe that the current economic growth trajectory is strong enough to withstand higher interest rates, and therefore, don’t see the need for further rate cuts this year. On the other hand, there are those who are growing increasingly concerned about the state of the jobs market, which could potentially justify a rate cut to stimulate hiring and economic growth.

This internal disagreement presents a headache for Powell, who has been walking a fine line between supporting the economy and keeping inflation in check. The Fed has already cut interest rates three times since July, and the question on everyone’s mind is whether another cut is on the horizon. Powell’s task is to balance the competing views within the Fed and make a decision that will keep the economy on a stable footing.

The labor market, in particular, is a key area of concern. While the unemployment rate remains low, there are signs that the jobs market is starting to slow down. The Fed’s Beige Book, a survey of economic conditions across the country, reported that several regions experienced a decline in employment growth. This has raised worries among some policymakers that the economy may be losing steam, and that a rate cut could be necessary to prevent a more significant downturn.

However, not everyone shares this view. Some officials believe that the economy is still growing at a healthy pace, and that the recent rate cuts have already done enough to support growth. They argue that further rate cuts could lead to inflationary pressures and asset bubbles, which would be detrimental to the economy in the long run.

Powell now faces the difficult task of weighing these competing views and making a decision that will be scrutinized by markets and the public. Will he opt for another rate cut to shore up the jobs market, or will he hold off, confident that the economy can continue to grow without further stimulus? The answer will have significant implications for the US economy, and Powell’s ability to navigate these choppy waters will be closely watched.