•

Balıkesir Gömeç’te Silahlı Saldırı: Ölüm Sayısı İkiye Çıktı

|

•

Aksaray’da Kontrolden Çıkan Araç Takla Atarak 3 Yaralı

|

•

Sarıyer'de Mantar Toplarken Kaybolan Kadın Sağ Salim Kurtarıldı

|

•

Kırıkkale'de Drone ile Trafik Denetiminde Yeni Dönem: 3.965 TL'lik Ceza Kesildi

|

•

Antalya Serik’te 5.000 m² Market Deposu Alev Aldı: Temel Gıdalar Kül Oldu

•

Balıkesir Gömeç’te Silahlı Saldırı: Ölüm Sayısı İkiye Çıktı

|

•

Aksaray’da Kontrolden Çıkan Araç Takla Atarak 3 Yaralı

|

•

Sarıyer'de Mantar Toplarken Kaybolan Kadın Sağ Salim Kurtarıldı

|

•

Kırıkkale'de Drone ile Trafik Denetiminde Yeni Dönem: 3.965 TL'lik Ceza Kesildi

|

•

Antalya Serik’te 5.000 m² Market Deposu Alev Aldı: Temel Gıdalar Kül Oldu

Reklam Alanı

AFAD’dan Zorlu Koşullarda Hızlı Müdahale: Kastamonu’da Hastayı Paletli Araçla Hastaneye Ulaştırdı

Sarıyer'de Mantar Toplarken Kaybolan Kadın Sağ Salim Kurtarıldı

Venezuela'da ABD Operasyonu: Ölüm Sayısı 80'e Çıktı

İran’da Ekonomik Gösterilerde Can Kaybı 20’ye Yükseldi

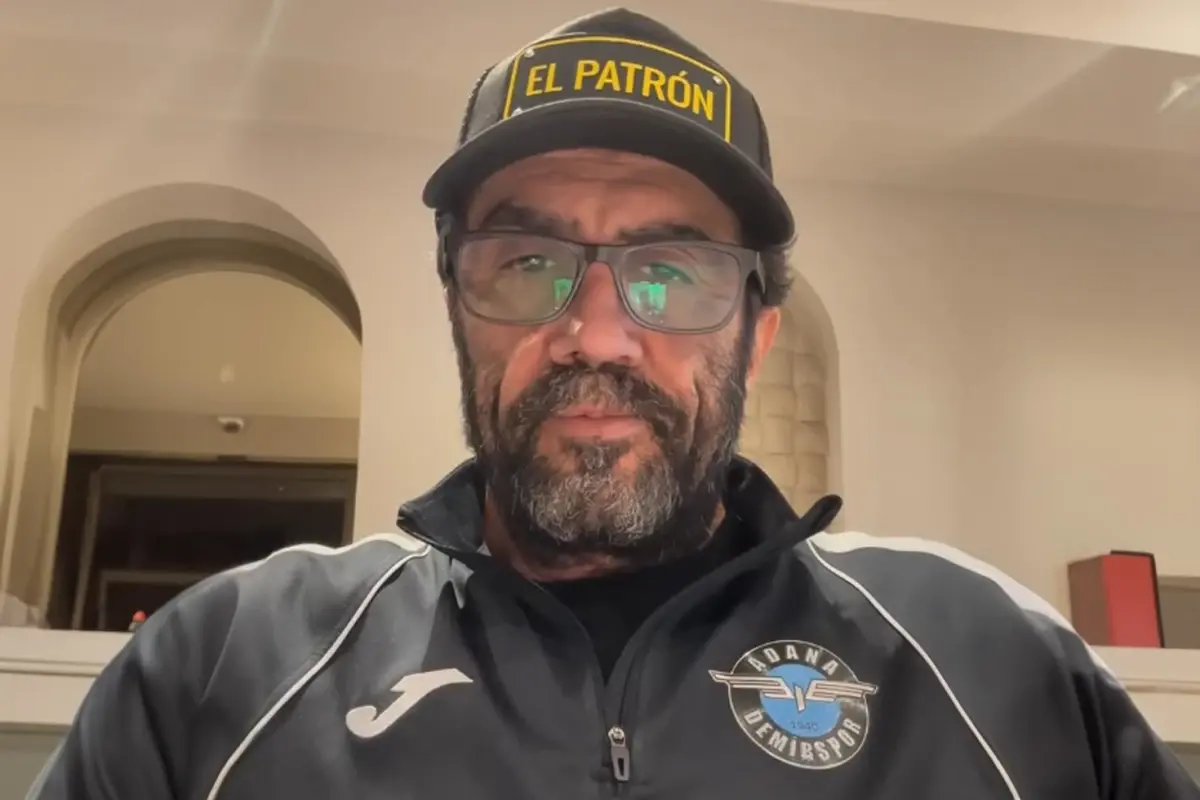

Bedri Usta’nın Sahibi Hastane Odasından Paylaştı: Sağlık Durumu ve Soruşturma Detayları

500 bin sosyal konut için kura çekimi 14 yeni ilde sürüyor

Trump, Grönland'ı Hedef Alıyor: Danimarka'ya Ekonomik Baskı Sözleri

Adana’da Şerit Değiştirirken Kadın Motosikletli Aracına Çarpan Otomobil Kazası

Fenerbahçe Beko, Beşiktaş GAİN'i 101-87'lik Skorla Geçti: 13 Maçlık Galibiyet Serisi Sonlandı

Fenerbahçe Beko, Beşiktaş'ı 101-87 Skorla Mağlup Etti

VİDEO

Tüm Videolar

Video

Fatih Tekke'den Okan Buruk'a Şok Açıklama: "Kilo Aldım"

Video

Hakkari İde Mezrası'nda Çığ Felaketi: 8 Ev ve 2 Ahır Hasar Gördü, 120 Küçükbaş Hayvan Öldü

Video

ABD Hava Operasyonu Sonrası Maduro, New York Sokaklarında Görüntülendi

Video

ABD'den Venezuela'ya Yeni Petrol Kısıtlaması: Rubio, Karantina Politikasıyla Baskıyı Artırıyor

Video

Beşiktaş Asbaşkanı Murat Kılıç'tan Transfer Güncellemeleri: Anlaşmalar Sağlandı, Rafa Silva Bekliyor

Video

Galatasaray'ın Trabzonspor Maçına Katılamayan 6 Oyuncu Açıklandı

Video

Miami'de Türk Güzellik Salonu, Evsiz Adamı Yeniden Hayata Döndürdü

Video

Venezuela Savunma Bakanı Padrino'dan Ülke Çapında Askeri Aktivasyon Açıklaması

Video

Balıkesir Erdek’te 8 Gün Sonra Bulunan Elif Kumal’ın Trajik Sonu

Video

Sarıyer'de Şiddetli Lodos Çınar Ağacını Döndürdü, Park Halindeki Araç Hasar Aldı

Akçakale Sınırında Kamyonla Gelen 51 Silah ve 41 Şarjör Ele Geçirildi

Akçakale Gümrük Kapısında 52 Uzun Namlulu Silah Ele Geçirildi

Fethiye Sahil Güvenlik, 58 Düzensiz Göçmeni ve 24 Çocuğu Kıyıya Çıkmadan Önledi

Cizre'de Güvenlik Stratejileri Masaya İndirildi

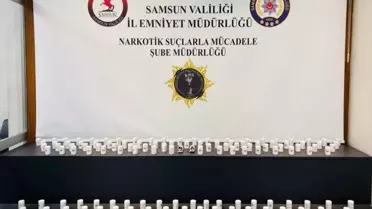

Muğla'da 12 Ayda 458 Kişi Uyuşturucu Suçundan Tutuklandı

Isparta’da Polis Operasyonu: 31 Aranan Kişi Yakalandı, 15 Bin Araç Kontrol Edildi

İzmir Konak'ta Silahlı Yağma Şüphesi: 24 Yıllık Hapis Cezalı Şahıs Yakalandı

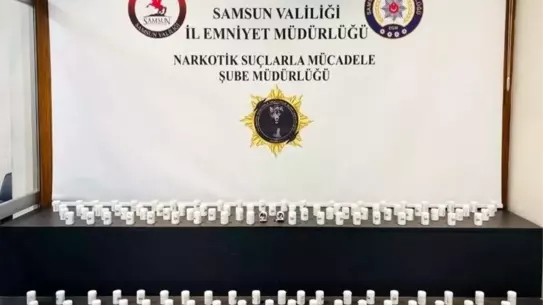

Samsun’da Büyük Uyuşturucu Operasyonu: 4 Şüpheli Yakalandı, 6.909 Hap Ele Geçirildi

Gaziantep’te Çatıdaki Kar Birikimini Fark Eden Çalışan Vatandaşı Hayata Kavuşturdu

Samsun Atakum’da Büyük Uyuşturucu Operasyonu: 6.909 Hap Ele Geçirildi, 4 Şüpheli Gözaltına Alındı

Trump, Grönland'ı Hedef Alıyor: Danimarka'ya Ekonomik Baskı Sözleri

Trump, Venezuela Lideri Delcy Rodríguez’e Uyarı Yaptı: Uymazsa Ağır Sonuçlar

Wang Yi, Uluslararası Hukuk Çerçevesinde Egemenlik Korumasını Vurguladı

Münih'te ABD'nin Venezuela Müdahalesi Protestosu: Katılımcılar Sessiz Direniş Gösterdi

Karayipler'de Hava Sahası Kısıtlamaları Resmen Kaldırıldı

İstanbul’da Şiddetli Lodos: Ağaçlar Devrildi, Araçlar Hasar Gördü

Trump, Venezuela'nın yeni lideri Rodriguez'e sert uyarı yaptı: "Daha ağır bir bedel ödeyeceksin"

ABD Hava Operasyonu Sonrası Maduro, New York Sokaklarında Görüntülendi

Yunanistan Hava Sahasında Teknik Arıza: 90 Uçuşta Kesintiye Yol Açtı

Amsterdam’da ABD’nin Venezuela Müdahalesine Yönelik Büyük Protesto

Kar Şartları Okulları Kapattı: Türkiye’nin Birçok İlinde Tatil Kararı

Aksaray’da Elektrikli Soba Kullanırken Elektrik Akımına Yakalanan Üniversite Öğrencisi Hayatını Kaybetti

Berlin'de Elektrik Kesintisi Okulları 4 Gün Kapattı: Sebepler ve Sonuçlar

Berlin’de Büyük Elektrik Kesintisi: 4 Gün Boyunca Okullar Kapandı

Konya Bilim Merkezi 2025’te Rekor Ziyaretçi Sayısına Ulaştı

İstanbul Metro Kazası: Üniversite Öğrencisi Berkay Uyar'ın Son Yolculuğu Samsun'da Duygusal Bir Törenle Gerçekleşti

Ağrı’da Karla Kapalı Okul Yolları Hızla Açılıyor

Muş Genç Ofis’ten Yurtdışı Eğitim Fırsatları: Öğrenciler Nasıl Gelişiyor?

Zonguldak Bülent Ecevit Üniversitesi'nden Çevreci Ölçüm Aleti Patentini Aldı

Manavgat'ta Okul Temizlik Görevlisi Sema Kayar Hayatını Kaybetti

Antalya Serik’te 5.000 m² Market Deposu Alev Aldı: Temel Gıdalar Kül Oldu

Karabük’te Şiddetli Kar, Seraları Yere Döktü: Çiftçi Kahramanlıkla Kurtarıldı

2026 Hazine Yardımları Açıklandı: AK Parti En Yüksek Destek Alacak

Ali Karahan, Türkeli Esnaf Odası'nda 317 Oyla Başkanlığa Yeniden Seçildi

Berber Ücretlerinde Şok Artış: Müşterileri Nasıl Etkileyecek?

Yoğun Kar Yağışı Bismil Çırçır Fabrikalarına Zarar Verdi

Karabük Berberler ve Kuaförler Odası'nda Erol Işık Yeniden Başkan Seçildi

Kula Şoförler Odası'nda Oktay Kırlı %50 Oy Farkıyla Yeniden Başkan Seçildi

Bozcaada Açıklarında Karaya Oturan Oman Bayraklı QENDIL Tankerinin Hikayesi

BYD, 2025'te Yeni Enerjili Araç Satışlarıyla Küresel Pazarın Zirvesine Çıktı

Ali Karahan, Türkeli Esnaf Odası'nda 317 Oyla Başkanlığa Yeniden Seçildi

Yoğun Kar Yağışı Bismil Çırçır Fabrikalarına Zarar Verdi

Türkiye-Azerbaycan 33 Milyar Metreküp Doğal Gaz Anlaşması 2029'da Başlıyor

KOSGEB, 2.440 KOBİ'ye Toplam 38,4 Milyar TL Destek Sağlayacak

KOBİ'lere Yeni Kredi Paketi: İş Dünyası Memnuniyetle Karşıladı

Trabzon’da Hamsi 100 TL’ye Çıktı, İstavrit Talebi Patladı

14 Şehirde Yüzyılın Konut Projesi Başlıyor: 500 Bin Yeni Sosyal Konut

Fenerbahçe, Ocak Ayında Bankalar Birliği'nden Ayrılıyor: Yeni Gelir Projeleri Açıklandı

Isparta’da Yerli Elma Çeşitleriyle Tarımda Çiçek Açıyor

Kangal Termik Santrali İşçileri TİS Ödemeleri İçin Sokağa Çıktı

Balıkesir Gömeç’te Silahlı Saldırı: Ölüm Sayısı İkiye Çıktı

AFAD’dan Zorlu Koşullarda Hızlı Müdahale: Kastamonu’da Hastayı Paletli Araçla Hastaneye Ulaştırdı

Sarıyer Ormanında Kaybolan Kadın Falezlerde Bulundu, Yaralı Durumu Sürüyor

Kırıkhan'da Silahlı Kuyumcu Soygunu: 3 Kilo Altın 3 Dakikada Çalındı

İran’da Ekonomik Gösterilerde Can Kaybı 20’ye Yükseldi

Venezuela'da ABD Operasyonu: Ölüm Sayısı 80'e Çıktı

Serik'te Soğuk Hava Deposunda Yangın Kontrol Altına Alındı

Hatay Dörtyol’da Karla Kaplı Yolda Mahsur Kalan Aile Güvenli Şekilde Kurtarıldı

Karabük Yenice'de Park Halindeki Araçta Çıkan Yangın Kontrol Altına Alındı

Bedri Usta’nın Sahibi Hastane Odasından Paylaştı: Sağlık Durumu ve Soruşturma Detayları

Sarıyer'de Mantar Toplarken Kaybolan Kadın Sağ Salim Kurtarıldı

Balıkesir'de Ölüm Olayı: Elif Kumal'ın Cenazesi Bursa'ya Taşındı

Adana’da Şerit Değiştirirken Kadın Motosikletli Aracına Çarpan Otomobil Kazası

Balıkesir'de Elif Kumal'ın Cesedi Bulundu: Ölüm Nedeni Soruşturma Altında

İmamın Namaz Pozu, Sosyal Medyada Tartışma Yarattı

Hülya Avşar, Tesettürlü Rolüyle İzleyicileri Büyülüyor

Balıkesir’de 8 Gün Sonra Kayıp Öğrencinin Cesedi Göl Kenarındaki Araçta Bulundu

İzmir Ekonomi Üniversitesi'nde Kız Öğrencileri Hedef Alan İnternet Sitesi Tepki Çekti

Balıkesir'de 8 Gün Aranan Genç Kadının Cansız Bedeni Gölette Bulundu

Güllü'nün Oğlu Tuğberk Yağız Gülter'den “Bitti” Açıklaması ve Tepkiler

Stuttgart'ta Telve Dergisi'nin 18. Sayısı Tanıtıldı

5. Uluslararası Genç Yazarlar Kurultayı Tamamlandı: 40 Yazar Yeni Ufuklara Yelken Açtı

Mardin'in Tarihi Sokakları Karla Büyülendi: 'Uzak Şehir' Çekimleri Buz Gibi Bir Atmosfer Kazandı

Yeşilgöz Gölü Karla Bembeyaz Bir Tabloya Dönüştü

Aşkale'den 20 Çocuk Palandöken'in Bembeyaz Kayak Pistinde Kızak Keyfi Yaşadı

Kabadüz’ün Çambaşı Kayak Merkezi Hafta Sonu Kalabalığıyla Coştu

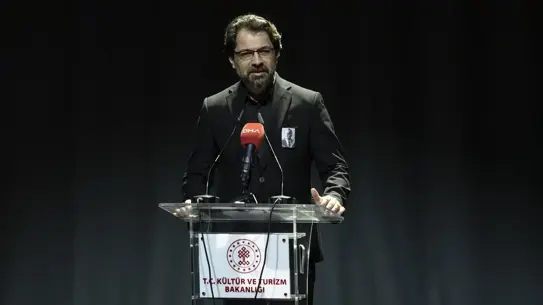

Opera Dünyasının Kayıp İncisi: Prof. Dr. Mesut İktu’nun Vefatı

Sakarya’da Ayakkabı Ustalığı: Geleneksel Zanaat Tehlikede

Türk Opera Sanatçısı Mesut İktu'nun Veda Töreni AKM'de Gerçekleşti

Adana’nın Tarihi Rölyefleriyle Canlanan Kültür Mirası

Hülya Avşar, Tesettürlü Rolüyle İzleyicileri Büyülüyor

Hasan Can Kaya’nın En Büyük Pişmanlığı: Cannes Başrol Teklifi ve Erzurum Kararı

İbrahim Tatlıses, 73 Yaşında İzmir'de Yeni Bir Aşkı Duyurdu

Mehmet Ali Erbil ve Gülseren Ceylan Boşanma Planlarından Vazgeçti: Canlı Yayında Barış Açıklaması

Gülben Ergen Tartışması Magazin Bahane’de: Siyaset ve Magazin Çatışması

Elazığ’da Kardan Adamın Başına Şaka: Kafası Hızla Çalındı

Beyazıt Öztürk'ün “Beyaz” Programı Joker Mesajıyla 4 Ocak’ta Kanal D’de

Settar Tanrıöğen: Beyin Kanamasıyla Mücadele Ederken Çektiği Zorlu Süreç

Filiz Çekil’in İnegöl Şubesinde Renkli Açılış ve Rus Mankenlerin Yeni Koleksiyonu

Öğretmenin Mini Etek Seçimi Sosyal Medyada Geniş Tartışma Yarattı

Hülya Avşar, Tesettürlü Rolüyle İzleyicileri Büyülüyor

Antep İşi Nakışı, Modern Tasarımlarla Yeniden Canlanıyor

Filiz Çekil’in İnegöl Şubesinde Renkli Açılış ve Rus Mankenlerin Yeni Koleksiyonu

Demet Özdemir'in Cannes Kırmızı Halı Şıklığı ve 7.385 Euro'luk Ralph Lauren Kombini

Mango Türkiye'de Kullanıcı Verilerini Kaybetti: Telefon ve E‑posta Bilgileri Çalındı

Hangzhou’da Liangzhu Kültür ve Yaratıcılık Pazarı Kapılarını Açtı

Zeki Triko'nun Efsanevi Kurucusu Ahmet Zeki Başeskioğlu 95 Yaşında Hayatını Kaybetti

LC Waikiki’nin Marka Stratejisini Şekillendirecek Yeni CBO: İsmail Seyis

Dülük Antik Kenti'nde Zamansız Moda Defilesi: Tarih ve Sanatla Buluşma

Dolikhe Antik Kenti'nde Genç Modanın Parlak Yüzü: Su Atacan Podyuma Çıktı

Kayseri Melikgazi’de Zincirleme Trafik Kazaları ve Elektrik Kesintileri

Aksaray’da Kontrolden Çıkan Araç Takla Atarak 3 Yaralı

Kırıkkale'de Drone ile Trafik Denetiminde Yeni Dönem: 3.965 TL'lik Ceza Kesildi

Gönen'de Araç Yangını Hızla Kontrol Altına Alındı

Karabük’te Park Halindeki Otomobil Aniden Yandı, Araç Kullanılamaz Hale Geldi

Karabük Yenice'de Park Halindeki Araçta Çıkan Yangın Kontrol Altına Alındı

Adana’da Şerit Değiştirirken Kadın Motosikletli Aracına Çarpan Otomobil Kazası

Karabük Yenice'de Park Halindeki Araçta Çıkan Yangın Hızlıca Kontrol Altına Alındı

Sakarya’da Drift Yapan Sürücüye 143 Bin TL Para Cezası Kesildi

İmamoğlu İlçesinde Polis Aracına Çarpan Sürücünün Hatası Olayı

İran’da Ekonomik Gösterilerde Can Kaybı 20’ye Yükseldi

Adıyaman’da Kuzenler Arasındaki Tartışma Silah Kullanımına Dönüştü: 1 Ölü

2026 Hazine Yardımları Açıklandı: AK Parti En Yüksek Destek Alacak

Trump, Grönland'ı Hedef Alıyor: Danimarka'ya Ekonomik Baskı Sözleri

Şamil Tayyar'dan YPG'nin Suriye Ordusundaki Talepleri ve Türkiye'ye Yönelik Uyarı

Eski İçişleri Bakanı Sadettin Tantan Hastanede: Durumu ve Aile Açıklamaları

Trump, Venezuela Lideri Delcy Rodríguez’e Uyarı Yaptı: Uymazsa Ağır Sonuçlar

Wang Yi, Uluslararası Hukuk Çerçevesinde Egemenlik Korumasını Vurguladı

Münih'te ABD'nin Venezuela Müdahalesi Protestosu: Katılımcılar Sessiz Direniş Gösterdi

Trump, Venezuela'nın Geçici Liderine Sert Uyarı Yaptı

AFAD’dan Zorlu Koşullarda Hızlı Müdahale: Kastamonu’da Hastayı Paletli Araçla Hastaneye Ulaştırdı

Sarıyer'de Mantar Toplarken Kaybolan Kadın Sağ Salim Kurtarıldı

Bedri Usta’nın Sahibi Hastane Odasından Paylaştı: Sağlık Durumu ve Soruşturma Detayları

Malatya’da Minibüs Çarpması Sonrası Yaşlı Sürücü 3,5 Ay Sonra Hayatını Kaybetti

Eski İçişleri Bakanı Sadettin Tantan Hastanede: Durumu ve Aile Açıklamaları

SILK Lazer Teknolojisiyle Göz Cerrahisinde Yeni Dönem

Psilosibin Araştırmaları: Depresyonda Yeni Bir Tedavi Seçeneği mi?

Polatlı’da Haşere İlaçlaması Sonrası Zehirlenme Olayı: 7 Kişi Hastaneye Kaldırıldı

Aksaray’da Elektrikli Soba Kullanırken Elektrik Akımına Yakalanan Üniversite Öğrencisi Hayatını Kaybetti

Kürtün'de Karla Kaplı Yolda Kamyonet Dereye Yuvarlandı, 5 Yaralı

Antalya Serik’te 5.000 m² Market Deposu Alev Aldı: Temel Gıdalar Kül Oldu

Hatay'ın Payas İlçesinde Ev Yangını Kontrol Altına Alındı

Venezuela'da ABD Operasyonu: Ölüm Sayısı 80'e Çıktı

Balıkesir'de Ölüm Olayı: Elif Kumal'ın Cenazesi Bursa'ya Taşındı

Düzce'de 26 Yaşındaki Genç Sokakta Silahla Kendini Yakarak Hayatını Kaybetti

Menteşe'de Kurt Saldırısı: 3 Koyun Hayata Veda Etti

Düzce'de 26 Yaşındaki Genç Kendini Silahla Vurdu, Hastanede Hayatını Kaybetti

Okan Buruk'tan Davide Frattesi İddialarına Net Yanıt: Transfer Listemizde Değil

Beşiktaş-Fenerbahçe Derbisinde Küfürlü Tezahüratlar Nedeniyle 15 Dakikalık Ara

Balıkesir'de Elif Kumal'ın Cesedi Bulundu: Ölüm Nedeni Soruşturma Altında

Çaykur Rizespor, Antalya’da Devre Arası Kampını Hızla Sürüyor

Nando De Colo, Fenerbahçe'ye Dönüşünü Resmen Onayladı

Fenerbahçe Beko, Beşiktaş GAİN'i 101-87 Skorla Geçti: 12. Zafer

Jonas Svensson, Beşiktaş'tan Ayrıldı: Rosenborg'a Dönüş Hazırlıkları Başladı

Kulüp Doktoru Yener İnce, Quinten Timber Transferini Sağlık Nedeniyle Engelledi

Lazio'dan Guendouzi Transferi Üzerine Açıklama: Fenerbahçe'ye Teklif Gelirse Engel Olmayacak

Okan Buruk'tan Davide Frattesi İddialarına Net Yanıt: Transfer Listemizde Değil

Manavgat Belediye Spor, İlk Yarıda 23 Puanla Liderlik Paylaşımını Sağladı

Fenerbahçe Beko, Beşiktaş GAİN'i 101-87'lik Skorla Geçti: 13 Maçlık Galibiyet Serisi Sonlandı

Galatasaray'dan Berkan Kutlu'ya Veda: 27 Yaşındaki Orta Saha Oyuncusuyla Yolları Ayrıldı

Kırıkkale'de Drone ile Trafik Denetiminde Yeni Dönem: 3.965 TL'lik Ceza Kesildi

İzmir Ekonomi Üniversitesi'nde Kız Öğrencileri Hedef Alan İnternet Sitesi Tepki Çekti

Kırklareli'de Durgun Sular Üzerinde Askeri Geçiş Eğitimini Başarıyla Tamamladı

BYD, 2025'te Yeni Enerjili Araç Satışlarıyla Küresel Pazarın Zirvesine Çıktı

Güdül'de Gizemli Işıklar: İki Arkadaşın UFO Görüntüleri

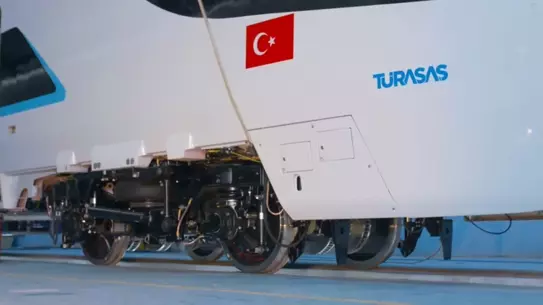

Milli Elektrikli Hızlı Tren Projesi 2026’da Test Aşamasına Giriyor

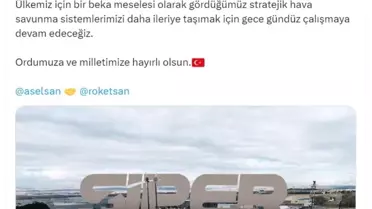

ÇELİKKUBBE'de Gelişmiş Siper Sistemi Teslimatı Başladı

Starlink, Venezuela'ya 1 Ay Ücretsiz İnternet Sağlayacak: Elon Musk'tan Yeni Girişim

Türkiye'nin İlk Elektrikli Hızlı Treni 2026'da Test Sürüşüne Çıkacak

Milli Elektrikli Hızlı Tren 2026’da Raylara Çıkıyor: Bakan Uraloğlu Ayrıntıları Paylaştı

Bozcaada Açıklarında Ham Petrol Tankeri Karaya Oturdu, Çevre ve Personel Güvende

Bozcaada Açıklarında Karaya Oturan Oman Bayraklı QENDIL Tankerinin Hikayesi

Bodrum’da Şiddetli Rüzgar Yelkenliyi Sürükledi, Tekne Yan Yattı

Bolu Tabiat Parkları 2025’te Rekor Ziyaretçi Sayısına Ulaştı

Malatya’da Buzlu Şölen: Günpınar Şelalesi Donarak Buz Sütunları Oluşturdu

Beypazarı Yaylalarında Yılkı Atları Göz Kamaştırdı

Göbeklitepe Karla Bembeyazlandı: Drone Kamerasıyla Büyüleyici Görüntüler

Türkiye, Çinli Turistlere Vizesiz Giriş İmkanı Sunuyor

Kabadüz’ün Çambaşı Kayak Merkezi Hafta Sonu Kalabalığıyla Coştu

Bodrum Sahillerinde Sürpriz Düşüş: Deniz Seviyesi 5 Metre Azaldı

Kar Şartları Okulları Kapattı: Türkiye’nin Birçok İlinde Tatil Kararı

Düzce'de 26 Yaşındaki Genç Sokakta Silahla Kendini Yakarak Hayatını Kaybetti

İmamın Namaz Pozu, Sosyal Medyada Tartışma Yarattı

Berber Ücretlerinde Şok Artış: Müşterileri Nasıl Etkileyecek?

Güllü'nün Oğlu Tuğberk Yağız Gülter'den “Bitti” Açıklaması ve Tepkiler

Miami'de Türk Güzellik Salonu, Evsiz Adamı Yeniden Hayata Döndürdü

Sinop’ta Unutulmaz Anlar: Yaban Domuzu Kucağa Alındı

Psilosibin Araştırmaları: Depresyonda Yeni Bir Tedavi Seçeneği mi?

Bursa’da Şiddetli Lodos Sokakta Korku Dolu Anlara Yol Açtı

İstanbul Metro Kazası: Üniversite Öğrencisi Berkay Uyar'ın Son Yolculuğu Samsun'da Duygusal Bir Törenle Gerçekleşti

Balıkesir Gömeç’te Silahlı Saldırı: Ölüm Sayısı İkiye Çıktı

AFAD’dan Zorlu Koşullarda Hızlı Müdahale: Kastamonu’da Hastayı Paletli Araçla Hastaneye Ulaştırdı

Kayseri Melikgazi’de Zincirleme Trafik Kazaları ve Elektrik Kesintileri

Aksaray’da Kontrolden Çıkan Araç Takla Atarak 3 Yaralı

Sarıyer'de Mantar Toplarken Kaybolan Kadın Sağ Salim Kurtarıldı

Sarıyer Ormanında Kaybolan Kadın Falezlerde Bulundu, Yaralı Durumu Sürüyor

Kırıkhan'da Silahlı Kuyumcu Soygunu: 3 Kilo Altın 3 Dakikada Çalındı

Hatay'ın Payas İlçesinde Ev Yangını Kontrol Altına Alındı

Serik'te Soğuk Hava Deposunda Yangın Kontrol Altına Alındı