December Rate Cut in Doubt as Fed Fault Lines Deepen, Minutes Show

Internal Split Over the Labor Market and Inflation

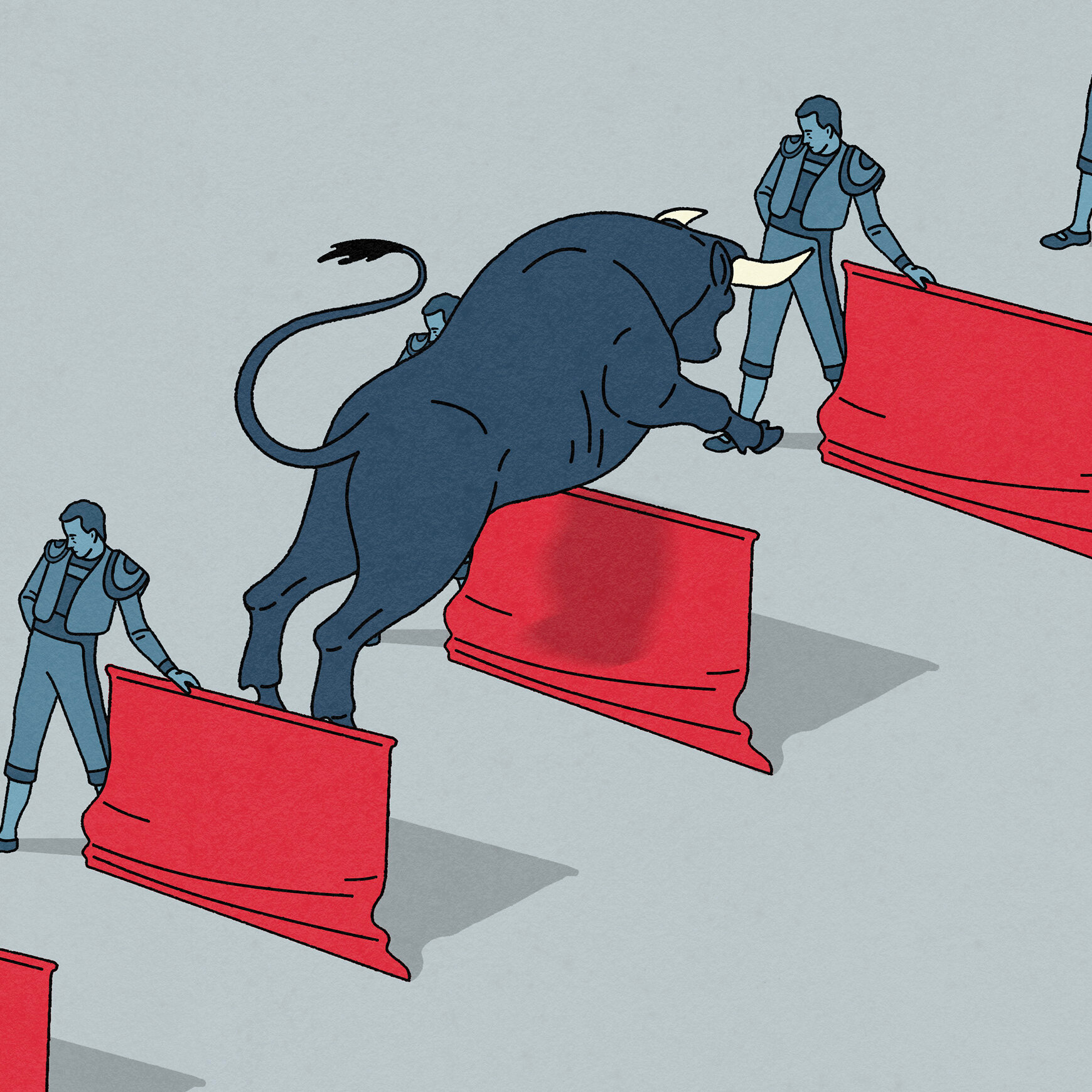

The Federal Reserve’s decision to trim rates last month turned out to be far more contentious than the initial press releases suggested. In the newly released minutes, several officials voiced starkly different views on how a cooling labor market should be weighed against persistent price pressures.

Weighing a Weakening Job Market

Some board members argued that the recent slowdown in hiring—highlighted by a rise in unemployment claims and a dip in job openings—signaled a need for a more cautious stance. They warned that premature easing could reignite inflationary forces that the economy has been battling for over a year.

Concern Over Rising Inflation

Conversely, a faction of the committee emphasized that core inflation remains above the Fed’s 2 % target. These officials contended that any rate reduction should be postponed until there is clearer evidence that price growth is on a sustained downward trajectory.

Implications for December’s Policy Meeting

The divergent opinions captured in the minutes suggest that the anticipated December rate cut is now on shaky ground. Market participants are likely to interpret the split as a signal that the next policy move could be a hold rather than a cut, keeping borrowing costs steady for the foreseeable future.

What’s Next?

Analysts will be watching upcoming labor data and inflation reports closely. A decisive shift in either direction could tip the balance within the Fed and determine whether the December meeting ends with a rate reduction, a pause, or even a surprise hike.

Fed’in faiz indirimi kararı çok tartışmalı görünüyor. İşgücü piyasası ve enflasyon arasındaki dengeyi bulmak zor olacak.