Poor Nations Received $1 Trillion From China — So Did Wealthier Countries

China’s loan diplomacy reaches far beyond the Global South

For years, analysts have portrayed Beijing’s overseas lending as a tool to win the loyalty of developing economies. Recent data, however, reveal a more nuanced picture: while poorer nations have indeed amassed roughly $1 trillion in Chinese loans, affluent states have tapped similar sums of financing.

A comprehensive study reshapes the narrative

A new research report released by the Global Finance Institute examined Chinese credit flows from 2000 to 2024. The authors found that the United States has received the largest total amount of Chinese financing—exceeding $1 trillion—surpassing every other country, rich or poor.

How the United States became the top recipient

Chinese investment in the United States spans a wide range of sectors, including technology, renewable energy, real estate, and infrastructure. The study highlights several high‑profile deals: a $150 billion partnership in semiconductor manufacturing, a $80 billion joint venture in offshore wind projects, and multiple acquisitions of iconic American brands.

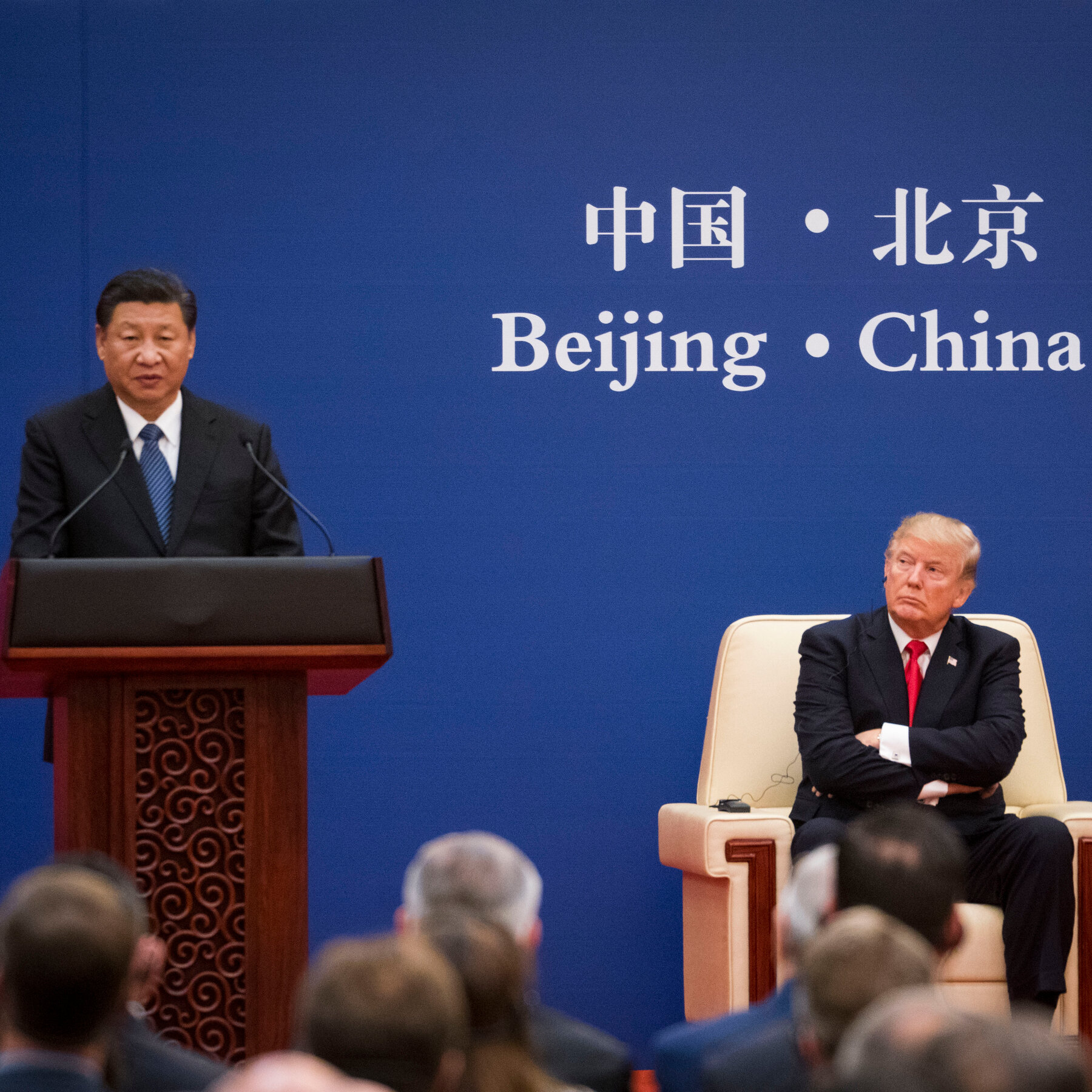

What this means for the global balance of power

The findings challenge the conventional view that China’s “debt‑trap diplomacy” is confined to low‑income countries. Instead, the data suggest that Beijing’s financial outreach is a strategic effort to embed itself in the economies of both emerging and advanced markets. As Dr. Lina Cheng, lead author of the report, notes, “Chinese capital is no longer a niche tool for influence; it is a mainstream source of funding for the world’s largest economies.”

Implications for policymakers

Governments worldwide may need to reassess how they evaluate foreign financing, weighing the economic benefits against potential geopolitical implications. The study urges greater transparency in loan agreements and calls for multilateral frameworks that can monitor and manage the growing web of Chinese investments.

Çin’in kredi diplomasisinin sadece gelişmekte olan ülkelerle sınırlı olmadığını öğrenmek gerçekten ilginç. ABD’nin Çin’den en fazla kredi alan ülke olması şaşırtıcı.