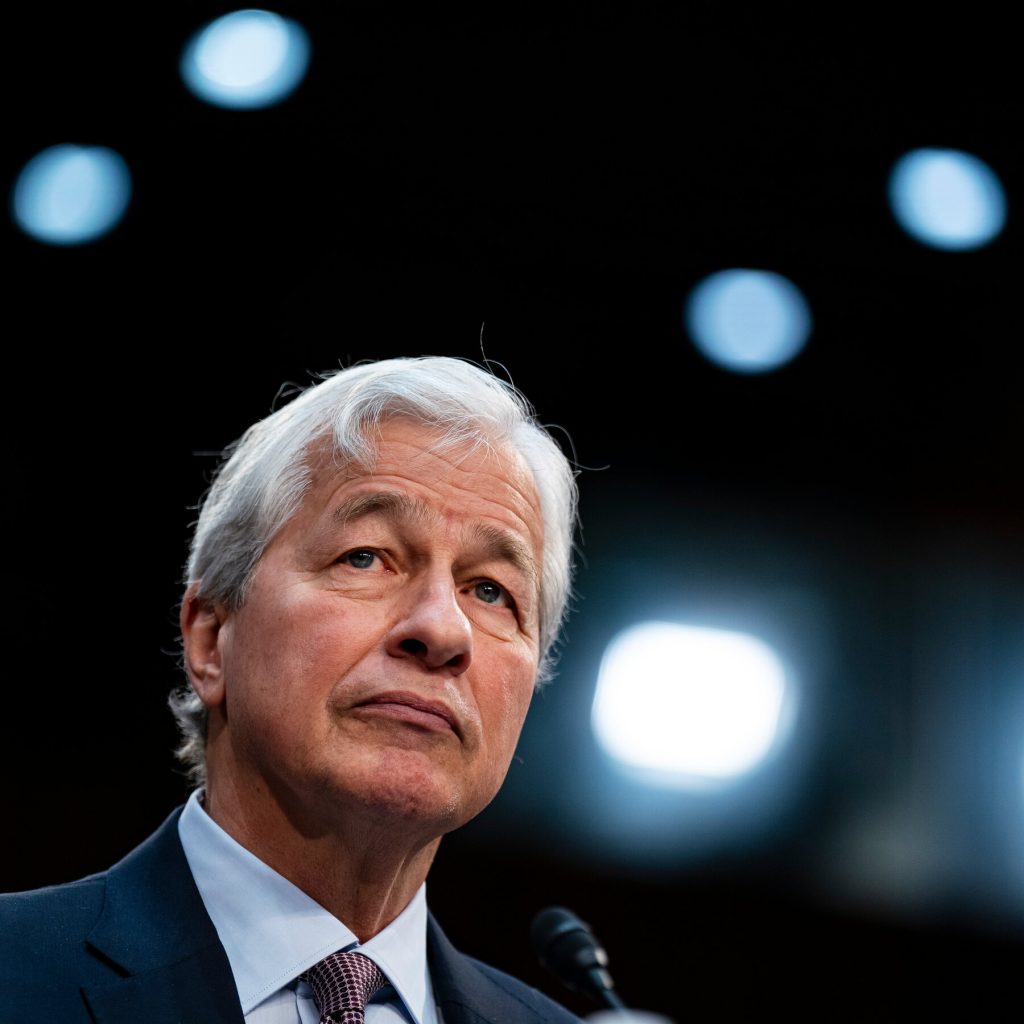

Warning Signs on the Horizon: Why Bank CEOs Like Jamie Dimon See Economic Trouble Ahead

The recent quarterly earnings reports from Wall Street’s behemoths have been nothing short of spectacular, with JPMorgan Chase, Bank of America, and Citigroup all boasting impressive profits. However, despite the rosy picture painted by these results, the chief executives of these financial giants are sounding a cautionary note about the economic landscape ahead. At the forefront of this cautious chorus is Jamie Dimon, the long-serving CEO of JPMorgan Chase, who has been vocal about his concerns regarding the potential for economic trouble on the horizon.

Dimon and his counterparts are closely monitoring a range of economic indicators, which suggest that the current benign environment may not last. While the US economy has continued to chug along, buoyed by low unemployment and steady growth, there are signs that the tide may be turning. Rising debt levels, both among consumers and businesses, are a particular concern, as are the ongoing trade tensions between the US and its major trading partners.

The CEOs are also keeping a close eye on the impact of monetary policy on the economy. The Federal Reserve’s decision to cut interest rates in recent months has been seen as a positive by some, as it has helped to keep borrowing costs low and support economic growth. However, others argue that this move may have merely delayed the inevitable, by masking underlying weaknesses in the economy.

Dimon, in particular, has been vocal about his concerns regarding the risks facing the economy. In a recent interview, he noted that while the current economic expansion has been long and strong, there are “a lot of things out there that could cause a recession.” He pointed to a range of potential flashpoints, including the ongoing trade tensions, the risk of a sharp decline in asset values, and the possibility of a global economic downturn.

Other bank CEOs are similarly cautious. Brian Moynihan, the CEO of Bank of America, noted that while his company’s quarterly results were strong, there are “crosscurrents” in the economy that bear watching. These include a slowdown in business investment, as well as a decline in consumer spending.

As the economic landscape continues to evolve, it is clear that the CEOs of Wall Street’s major banks are girding for a potential downturn. While the current earnings reports may paint a rosy picture, the warning signs are there, and Dimon and his counterparts are urging caution. As the saying goes, “pride comes before a fall,” and it seems that these bank CEOs are determined not to be caught off guard when the economic cycle inevitably turns.